2 Potentially Explosive Crypto Stocks to Buy in April

With Bitcoin prices still above $60,000, the crypto market remains red hot despite a recent pullback. If you want to increase your exposure, you could of course buy Bitcoin directly, or any other cryptocurrency for that matter.

But there are other ways to increase your exposure to crypto, even through conventional stocks. Two crypto stocks in particular are primed for an explosive 2024 and beyond.

This stock is betting on crypto for the masses

Most people think of PayPal (NASDAQ: PYPL) as a payments company. With more than 400 million users, there's a good chance you've used PayPal personally, either to buy something online or to send money to a friend or family member. This is still the company's bread and butter. Its users rely on the company to provide a safe, secure, and reliable way to transact digitally. If something unintentional happens -- like purchasing a fraudulent product or sending money to the wrong business -- PayPal can step in and right the error.

In 2013, PayPal made an $800 million bet by acquiring Venmo, a peer-to-peer money app. Through a smartphone, Venmo users can send and receive money from anyone in a few clicks. The service is part of a megatrend called the democratization of finance -- empowering everyday people to have more control over their money.

PayPal's purchase of Venmo turned out to be a terrific business decision. In 2013, Venmo users used the app to send only a few billion dollars between themselves. Last quarter, however, nearly $70 billion was sent through Venmo's platform. A growing percentage of that volume is comprised of crypto payments. That's because, last year, the company introduced crypto payments. With Venmo, anyone can now purchase and transact in a variety of cryptocurrencies, including Bitcoin.

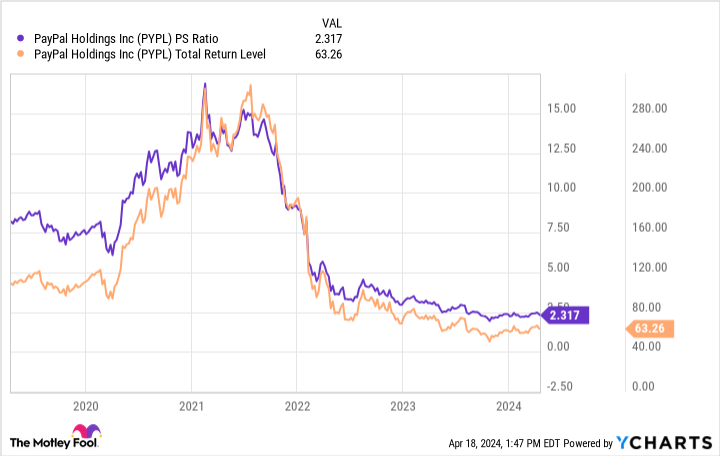

Lately, PayPal's traditional business has been shrinking, causing the stock to trade a deep discount to its historical valuation. Crypto could provide a new pillar of growth. After all, few companies have an existing 400 million strong user base that it can seamlessly plug into the crypto ecosystem. While it will take time for crypto to become a meaningful driver of PayPal's growth, few companies in the world can match its potential. PayPal already has mass scale. If it can bridge the gap between its huge user base and the rapid rise of crypto, shares could soar, especially given the depressed valuation.

Go all-in on blockchain with this crypto stock

Similar to PayPal, Block (NYSE: SQ) stock also has exposure to crypto payments. Unlike PayPal, however, there are multiple ways to win here.

Block has its own Venmo competitor called Cash App. The app has about 50 million users versus Venmo's roughly 70 million users. Like Venmo, anyone can use Cash App to buy, sell, and transact in a variety of cryptocurrencies. In this regard, Block provides similar crypto exposure to PayPal.

But Block has several more crypto-related business lines, too. Its software divisions, TBD and Spiral, for example, build open-source tools and ecosystems to accelerate the development and adoption of crypto. Its Square platform, meanwhile, which allows merchants to quickly and easily adopt mobile payments, now accepts crypto as a form of payment. Even the company's music streaming app, Tidal, is exposed to crypto. Many companies have experimented with using blockchain for copyright verification and transparent payments. If this trend takes off in the music industry, Block will have a front row seat.

The best news is that, like PayPal stock, Block stock is currently on sale. Right now, shares are valued at just 2 times sales. A few years ago, its price-to-sales multiple was above 10. Growth has slowed for the company recently, with profitability becoming unreliable. But if you're a long-term believer in the growth of crypto, few stocks offer as much direct exposure as Block.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of April 15, 2024

Ryan Vanzo has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin, Block, and PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

2 Potentially Explosive Crypto Stocks to Buy in April was originally published by The Motley Fool